Senior Living is the #1 Performing Commercial Asset Class in 10 Years

Our purpose is to help close the 600,000 bed gap needed by 2050.

We believe that assisting living is going to continue to be a primary source of long-term care for millions of Americans. The problem is that the current big box senior living industry is broken because large facilities are poorly run, costing Americans millions of dollars per year for poor quality care. We extract value out of existing, but poorly managed, cash flowing boutique senior living homes, and we rebrand those homes and implement our processes and procedures to provide industry leading care under our management company: Shepherd Premier Senior Living.

Boutique Senior Living Fund invests in real estate assets focused in the senior living sector primarily in the midwest. We are raising twenty five million dollars ($25,000,000) and we are targeting a 15.2% Internal Rate of Return (IRR) for our investors. What that means to our investors is they will help 1,000’s of families, grandma’s and grandpa’s. What that really means to our investors is they will double their money every 6.2 years

10,000 baby boomers turn 65 every single day

The demand for more, quality senior living options is not going away. Our seniors are living longer than ever before and many of them are looking for community living situations that cater to. . .

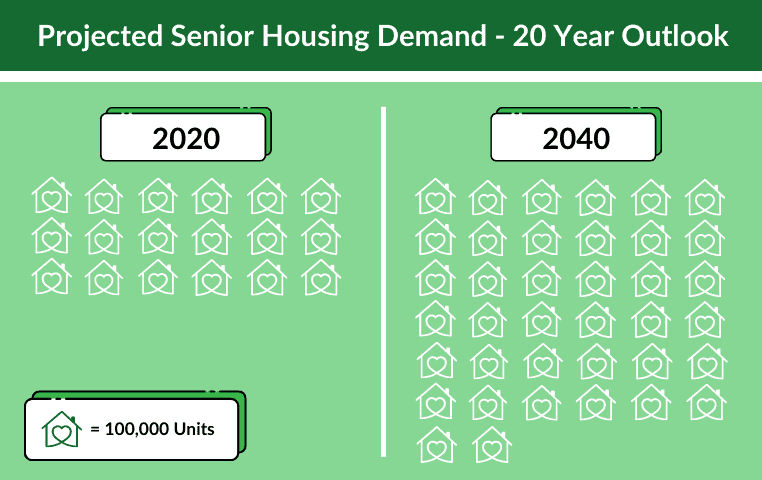

Using the 80-plus household cohort as a baseline — 1.592 million units — to determine that senior living will need nearly 986,000 new units between now and 2040, based on an 18% penetration rate. Nearly 881,000 new units will be needed between now and 2030.

Own the #1 Performing Commercial Asset Class of the Last 10 Years

Download our exclusive white paper on the smartest investment of 2022:

“According to studies, 10,000 baby boomers turn 65 years old every single day. As that pace continues, it is forecast that there will be around 80 million senior citizens within the next decade. That rate of growth is double what it was at the beginning of the 2000s.”

-Lloyd Jones

Why Boutique Senior Living Homes

Beat the “Big Box” Facilities

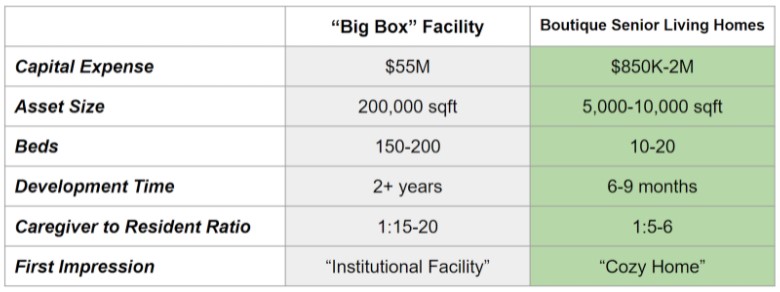

For the average senior or family or a senior, walking into one of the big box facilities is like walking into a hospital. The buildings are enormous, caretaker-to-resident ratios can be 1:20 and, let’s face it, with their inability to quickly adapt to change, COVID-19 was a mega-facility’s worst nightmare.

On the other hand, Boutique Senior Living happens in quality residential settings that feel warm and inviting. The care ratio is 1:5-6, we use the latest technology, are quick to adapt to changing market conditions and are virtually recession proof. In fact. . .

Properties Funded by Boutique Senior Living Fund

16 Bed Assisted Living

16 Bed Assisted Living

10 Bed Assisted Living

10 Bed Assisted Living/Memory Care

12 Bed Assisted Living/Memory Care

16 Bed Assisted Living/Memory Care

Ready to Get Started?

Boutique Senior Living Fund is headquartered at 7716 Crystal Springs Rd, Crystal Lake, IL 60012.

The views expressed herein are those of the authors and do not necessarily reflect the official views of Boutique Senior Living Fund, LLC (“BSLF”), its personnel, or its affiliates. This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult with your own advisers as to those matters before making any investment decision. Certain information contained herein has been obtained from third-party sources, including companies of funds managed by BSLF. While taken from sources believed to be reliable, BSLF has not independently verified such information and makes no representations or warranties about the enduring accuracy or completeness of the information or data provided or its appropriateness for any given situation. Additionally, BSLF has not reviewed anny advertisements and does not endorse any advertising content contained herein. The charts and graphs provided are for informational purposes only and should not be relied upon when making any investment decision. Past performance is not indicative of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. References to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not be relied upon when deciding to invest in any fund managed by BSLF. An offering to invest in a BSLF fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety. Neither BSLF nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence.

Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by BSLF, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Brandon Schwab (excluding investments for which the issuer has not provided permission for a BSLF to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://

©2022 Boutique Senior Living Fund | Privacy Policy | Terms of Service

Senior Living is the BEST Commercial Asset Class

Learn the secrets of why America’s wealthy are investing heavy into the Senior Living Industry…

Make Investments That Help Seniors & Give Back

Strong Returns

Make returns much higher than the typical bank certificate of deposit

Limit Your Risk

All investments have risk, however senior living is recession proof

Healthy Portfolio

Diversification

By investing in senior living, you will diversify your investment dollars

4000

# of Americans

Turn 85 Daily

10K

# of Americans

Turn 65 Daily

60K

Number of Beds Needed to Be Built Each Year to Keep Up with 2035 Demand of Seniors

68

Beds

Funded

Our Boutique Senior Living Fund

ONLY Invests in Boutique Senior Living Assets across United States with Proven Operators!

Record High Senior

Population

Strong Returns Over Market

Ultimate Feel Good

Investment

Monthly Reporting

Smart Investing

Ask About Tax Relief Using

IRA

Current Funded Boutique Senior Living Fund

10 Bed Assisted Living

14 Bed Assisted Living

10 Bed Assisted Living

16 Bed Assisted Living/Memory Care

16 Bed Assisted Living/Memory Care

96 Bed Assisted Living/Memory Care

Ready to Get Started?

expert answers to your boutique senior living questions!

©2022 Boutique Senior Living Fund | Privacy Policy | Terms of Service