Real-Life Examples of Small Homes Outperforming Big Facilities

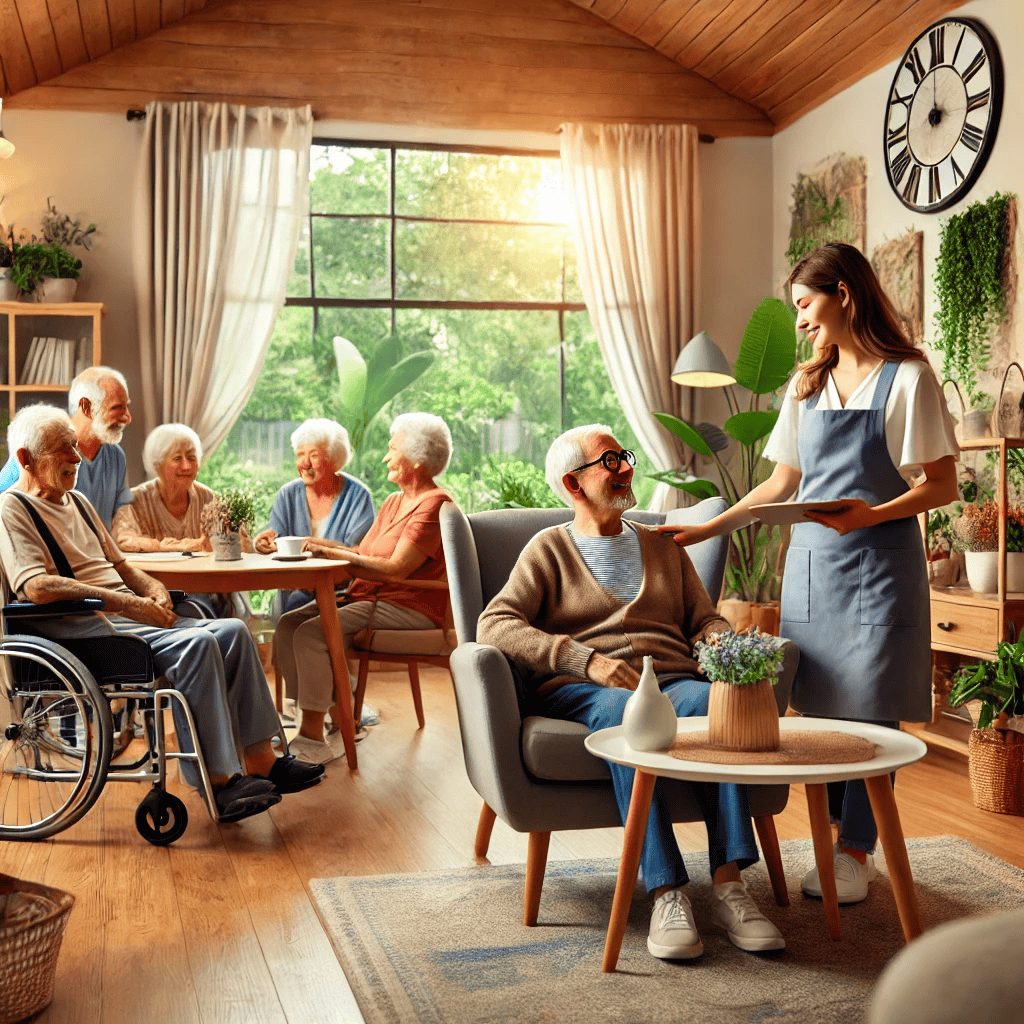

The senior living industry is at a crossroads. With an aging population and a demand for over 775,000 new beds by 2030, families are looking for better options than traditional big-box facilities. But what if the best solution isn’t bigger buildings, but smaller, more intimate homes? At Shepherd Premier Senior Living (SPSL), we believe small […]

Real-Life Examples of Small Homes Outperforming Big Facilities Read More »