How ESG Investors Evaluate Senior Housing

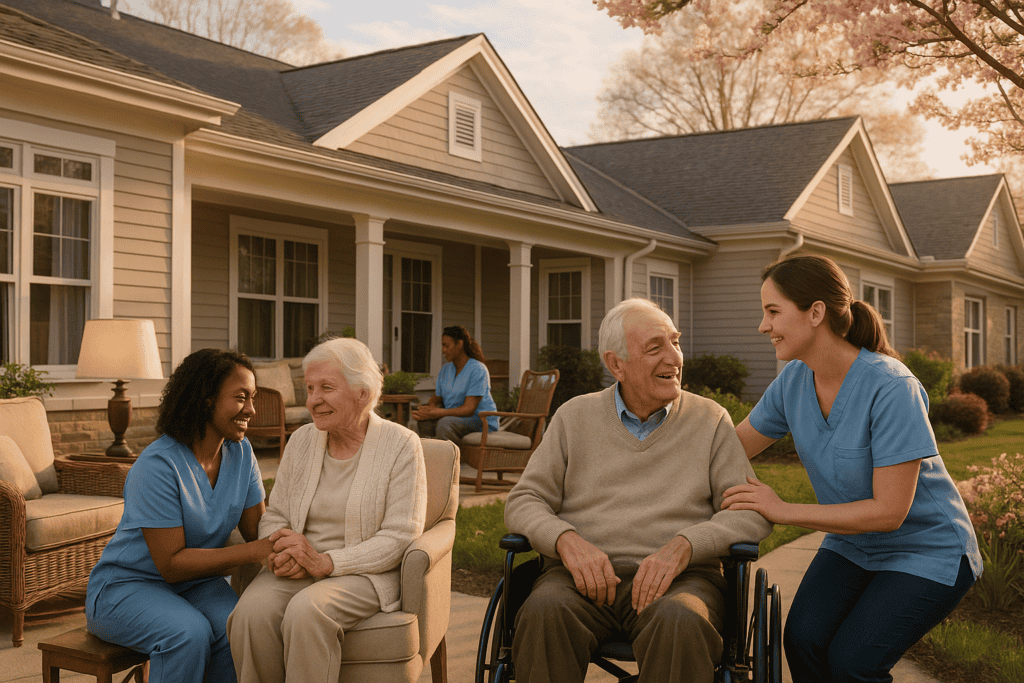

As ESG (Environmental, Social, Governance) investing grows, senior housing is stepping into the spotlight—not just for its returns, but for its impact. Yet not all senior living is created equal. Investors are shifting away from sterile, big-box facilities toward smaller, personalized homes that prioritize dignity, care quality, and operational transparency. This shift aligns perfectly with […]

How ESG Investors Evaluate Senior Housing Read More »