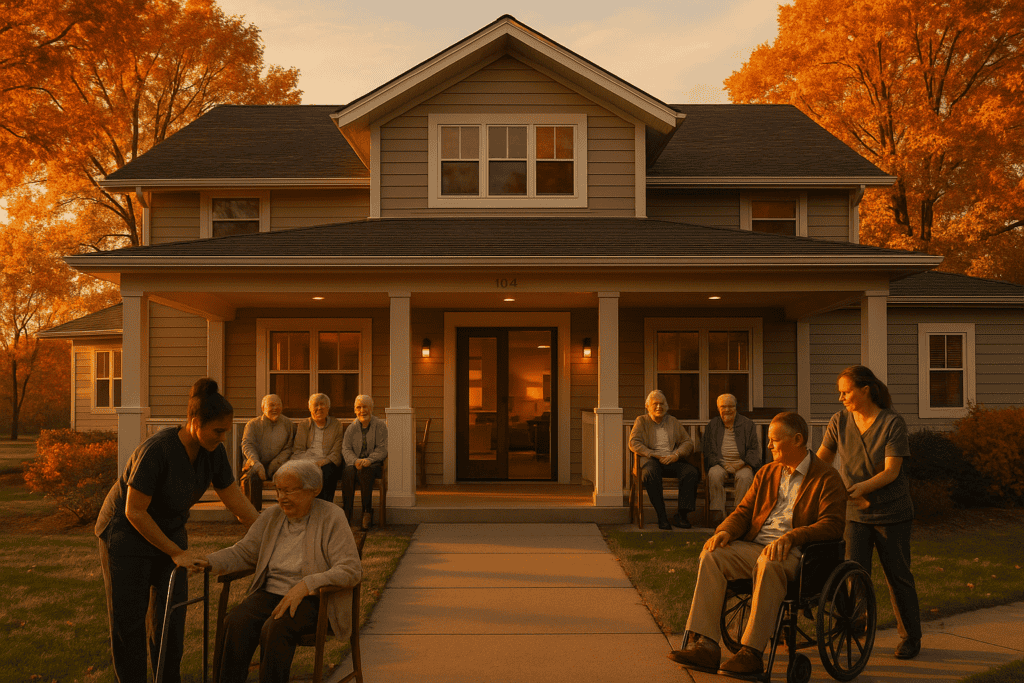

Investing in senior care isn’t just a financial decision—it’s a mission-driven opportunity to transform lives while earning compelling returns. Shepherd Premier Senior Living Fund offers investors a unique lifecycle journey that blends boutique real estate, compassionate care, and disciplined financial execution.

Phase 1: Discovery & Commitment 💼

The investment journey starts with alignment—between the investor’s goals and the Fund’s mission. Accredited investors explore pitch decks, attend webinars, or speak directly with Investor Relations lead Derek Jackson. Once ready, they complete subscription documents and become Limited Partners (LPs), officially entering the fund.

Phase 2: Capital Deployment & Acquisition 🔍🏠

Funds raised are allocated toward acquiring boutique senior homes—often 10–30 bed properties in under-served Midwest communities. These homes are usually underperforming yet ripe for improvement. Shepherd acquires these at ~14% cap rates, well above industry averages.

Phase 3: Operational Transformation & Synergy Pods 🔧🤝

Immediately post-acquisition, the homes are integrated into a local “pod” system. This enables shared staffing, purchasing, and administration—boosting efficiency without compromising the high caregiver-to-resident ratio (typically 1:5–1:6). Renovations, compliance upgrades, and resident experience improvements follow swiftly.

Phase 4: Stabilization & Occupancy Growth 📈

With enhanced care quality and local outreach, occupancy begins to rise—often reaching 85–95% within 12–24 months. This increases Net Operating Income (NOI), which is key for the next stage of the lifecycle.

Phase 5: HUD Refinance & Value Creation 🏦📊

Once stabilized, the property qualifies for HUD-backed refinancing at a much lower cap rate (~8%). This not only boosts the property’s valuation but often returns capital to investors while maintaining strong ongoing distributions. It’s the cap-rate arbitrage engine at work—14% in, 8% out.

Phase 6: Distributions & Long-Term Wealth Building 💵🕰️

With refinance proceeds and growing cash flow, investors typically receive quarterly or semi-annual distributions. The fund targets ~10% annual cash-on-cash returns and an 18–22% IRR over 7–10 years. LPs enjoy both consistent income and wealth appreciation—alongside the peace of knowing their capital improves lives.

For more information and an exclusive white paper, please call or text Derek at 808-721-8189 📞.