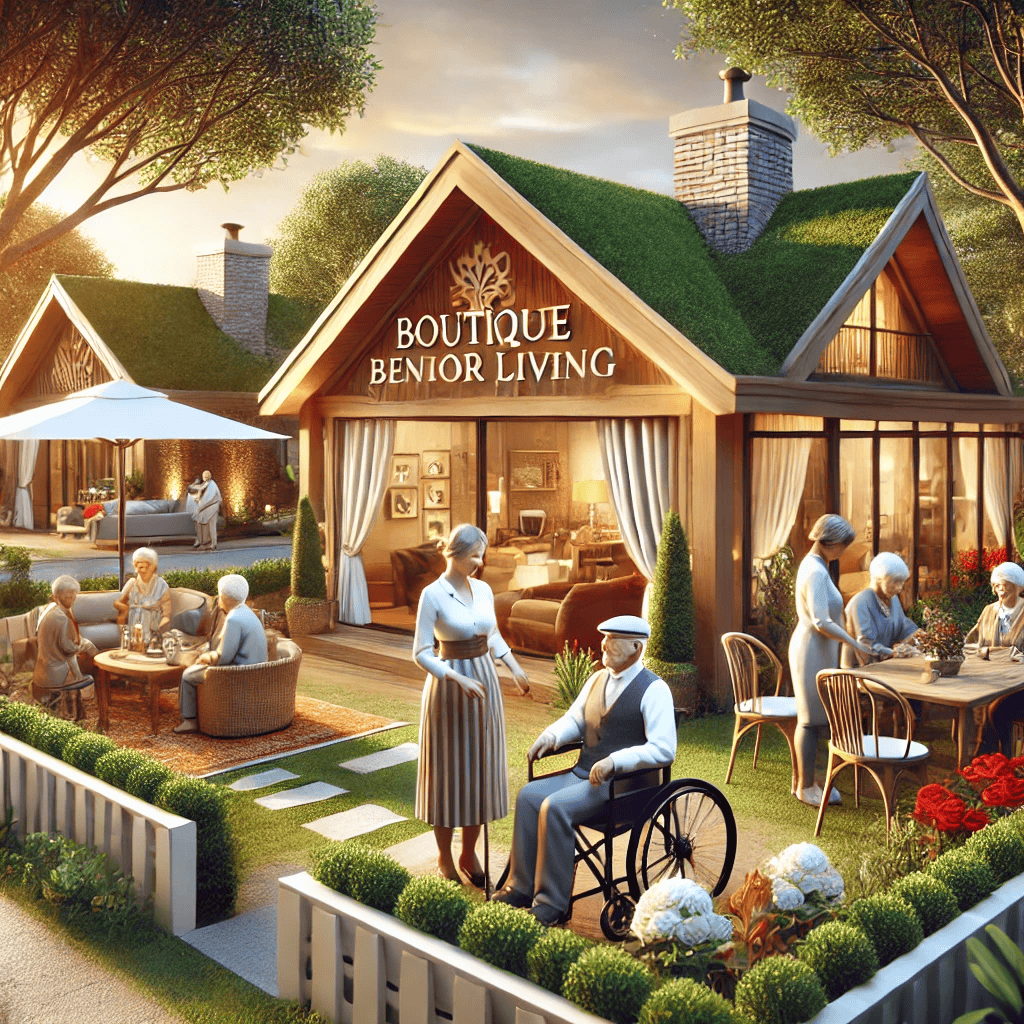

In a world where the demand for senior living continues to grow exponentially, boutique senior living has emerged as a game-changing model for care and investment. Traditional facilities often prioritize scale, but boutique homes—characterized by smaller, cozier, and more personalized environments—are proving to deliver not only superior care but also exceptional financial returns. Here’s how boutique senior living is charting a path to target a 20% internal rate of return (IRR).

1. Market Demand and Demographics

The senior living industry is poised for unprecedented growth. By 2030, all baby boomers will be over the age of 65, with over 70% expected to require some form of senior care in their lifetimes. Boutique senior living homes, offering 10-20 bed facilities, meet this demand by catering to families seeking intimate, high-quality care for their loved ones. This niche not only fills a market gap but also ensures consistent occupancy rates, a critical driver of profitability.

2. Premium Pricing Through Personalized Care

Unlike large facilities, boutique senior living emphasizes individual attention and customized care plans. Families are willing to pay a premium for this level of service. This pricing power translates directly into higher margins, making boutique models an attractive option for investors.

For example, a home offering four times the caregiver-to-resident ratio of a traditional facility can command higher monthly fees while maintaining a cost-efficient structure.

3. Scalable Yet Targeted Investment Model

Boutique senior living operators often employ a rollup strategy to expand their portfolios, acquiring and converting residential properties into boutique care homes. This approach is capital efficient and allows for rapid scaling without sacrificing quality. By maintaining a focus on smaller, local markets, operators can drive consistent occupancy and minimize marketing overhead.

4. Operational Efficiency Through Community Engagement

Boutique senior living facilities often rely on grassroots efforts to build their reputation. Word-of-mouth referrals from local families, partnerships with community organizations, and social proof through testimonials significantly reduce acquisition costs. Additionally, lean operational teams ensure that expenses are tightly controlled, further improving profitability.

5. Tax Advantages and Real Estate Appreciation

Investing in boutique senior living properties often comes with built-in tax advantages, such as depreciation deductions. Moreover, the underlying real estate tends to appreciate over time, providing an additional layer of value for investors. Combining strong operating cash flow with appreciating assets creates a powerful formula for achieving target IRRs.

6. Addressing Industry Challenges

While boutique senior living is a lucrative opportunity, it is not without challenges. Operators must carefully balance scalability with maintaining high-quality care. Recruiting and retaining passionate caregivers is critical, as is ensuring compliance with regulatory standards. However, well-executed strategies in these areas can turn potential hurdles into competitive advantages.

7. Case Study: Shepherd Premier Senior Living

Shepherd Premier Senior Living exemplifies the boutique model’s potential. By focusing on small, personalized homes, they have achieved higher occupancy rates and strong financial performance. Their strategy to scale from nine homes to 30, and eventually thousands, highlights the model’s scalability while maintaining its core values.

Conclusion: A Compelling Investment Opportunity

Boutique senior living represents a unique intersection of compassionate care and attractive returns. By leveraging growing demand, premium pricing, operational efficiencies, and real estate appreciation, this model targets a 20% IRR, making it a standout opportunity in today’s market.

Investors seeking to align their portfolios with both purpose and profit should consider boutique senior living—an industry poised for remarkable growth and transformative impact.

To learn more about this thriving sector or discuss investment opportunities, contact us today. Let’s shape the future of senior living together!