Explaining NOI for Senior Living Real Estate Investors

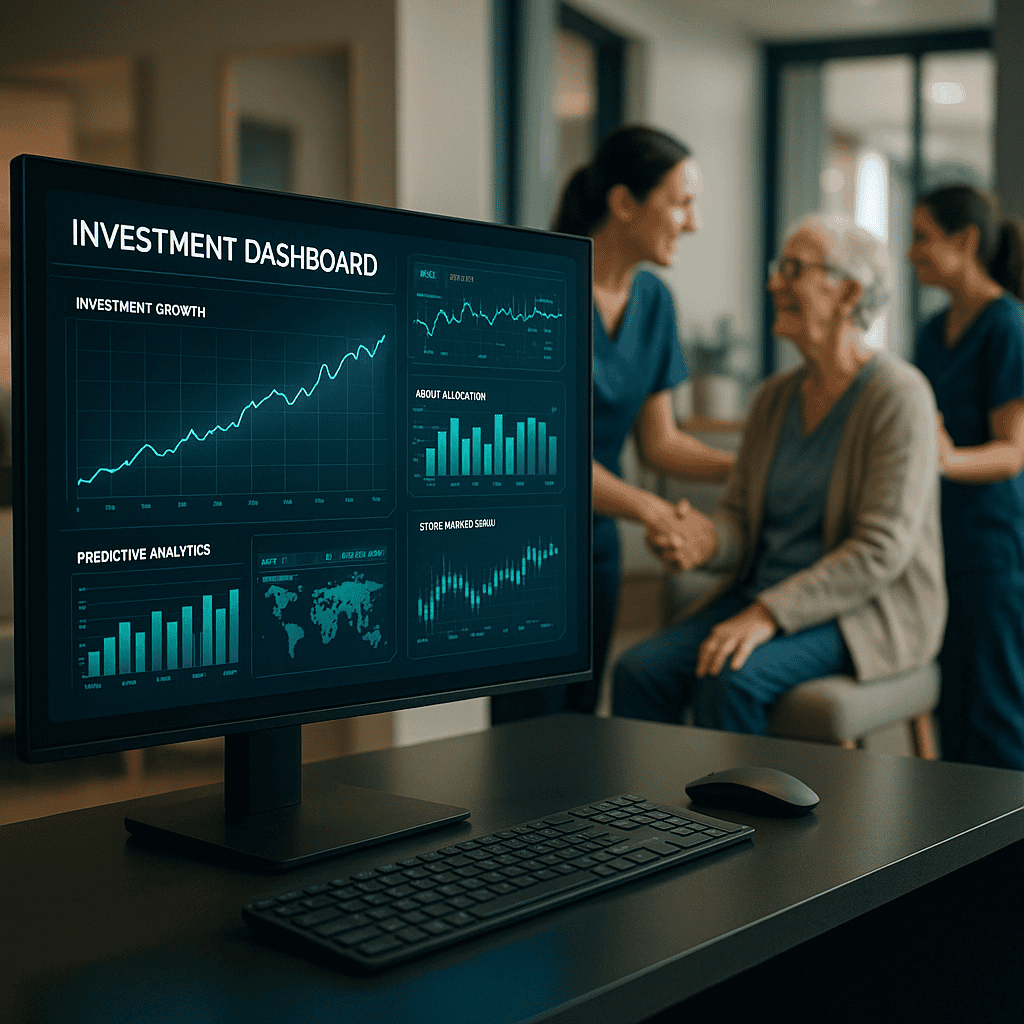

When it comes to investing in senior living real estate, few metrics are as foundational—or as misunderstood—as Net Operating Income (NOI). Whether you’re analyzing a boutique assisted living facility or a larger care campus, NOI offers a window into your property’s financial health and its potential for refinancing, valuation, and eventual exit. What Is NOI […]

Explaining NOI for Senior Living Real Estate Investors Read More »