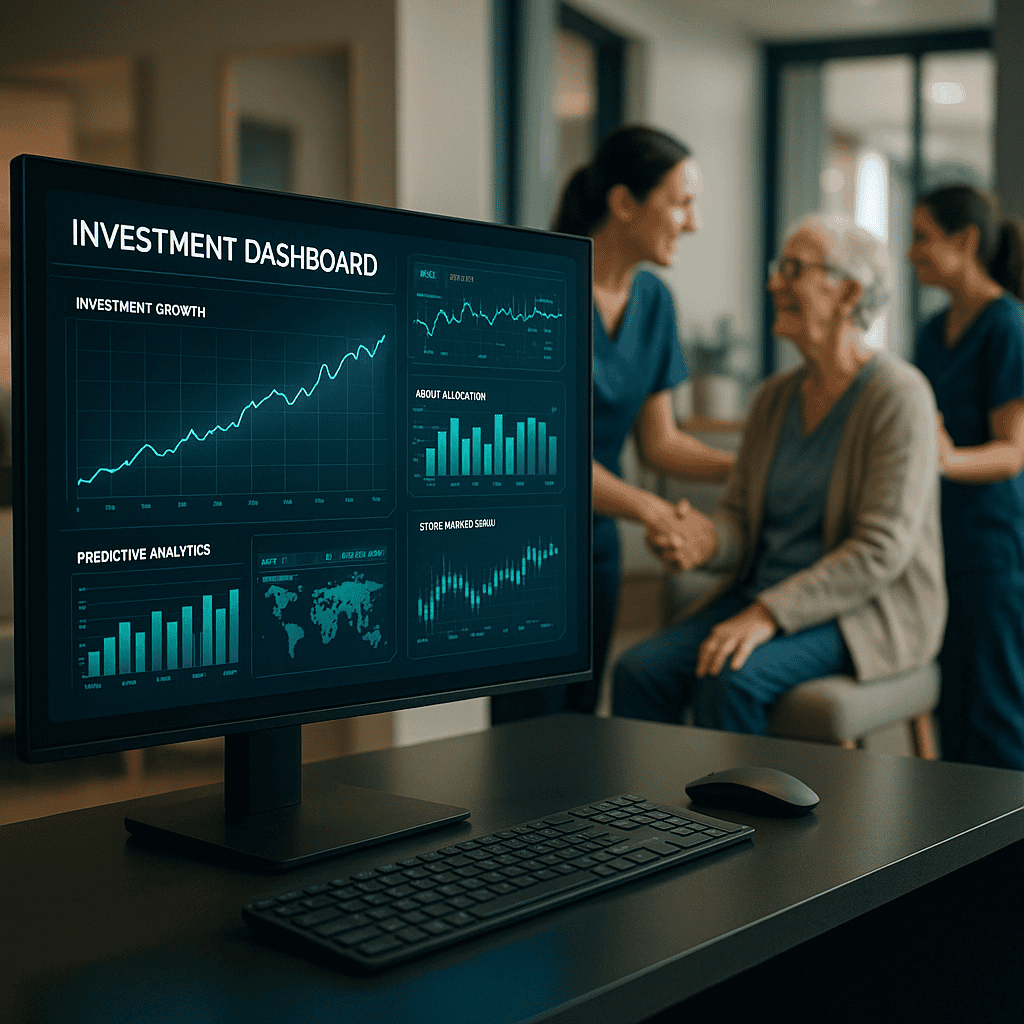

In today’s rapidly evolving investment landscape, technology is no longer a luxury—it’s a necessity. From automated dashboards to predictive analytics, fund managers and investors alike are harnessing AI and operational tech to streamline decisions and reduce waste. In real estate private equity, especially in complex sectors like senior living, these tools are proving indispensable for driving both transparency and profitability.

🚀 Real-Time Insights & Operational Precision

Tech-driven platforms like Shepherd Premier’s CashFlowGPT and CaretakerSyncGPT exemplify this shift. These AI systems offer real-time financial tracking, IRR projections, and staffing optimization. For investors, this means fewer surprises, better communication, and faster access to metrics that matter. It’s about cutting through the noise and focusing on outcomes—improving both resident well-being and fund performance.

🏆 Cap Rate Arbitrage Meets AI Efficiency

Shepherd’s strategy of acquiring properties at a 14% cap rate and refinancing at ~8% via HUD-backed loans is already a strong play. But when combined with AI-powered underwriting, occupancy monitoring, and compliance checks, the fund not only scales more efficiently—it also minimizes financial leakage. It’s not just “doing more with less”—it’s doing smarter with less.

🔄 Automation That Builds Trust

For LPs, trust is built through consistent, transparent communication. Platforms like PitchDeckGPT and OccupantSatisfactionGPT allow the fund to share verifiable metrics—caretaker ratios, satisfaction scores, refinance event data—automatically. This eliminates manual bottlenecks and enhances credibility, a key factor in securing long-term capital commitments.