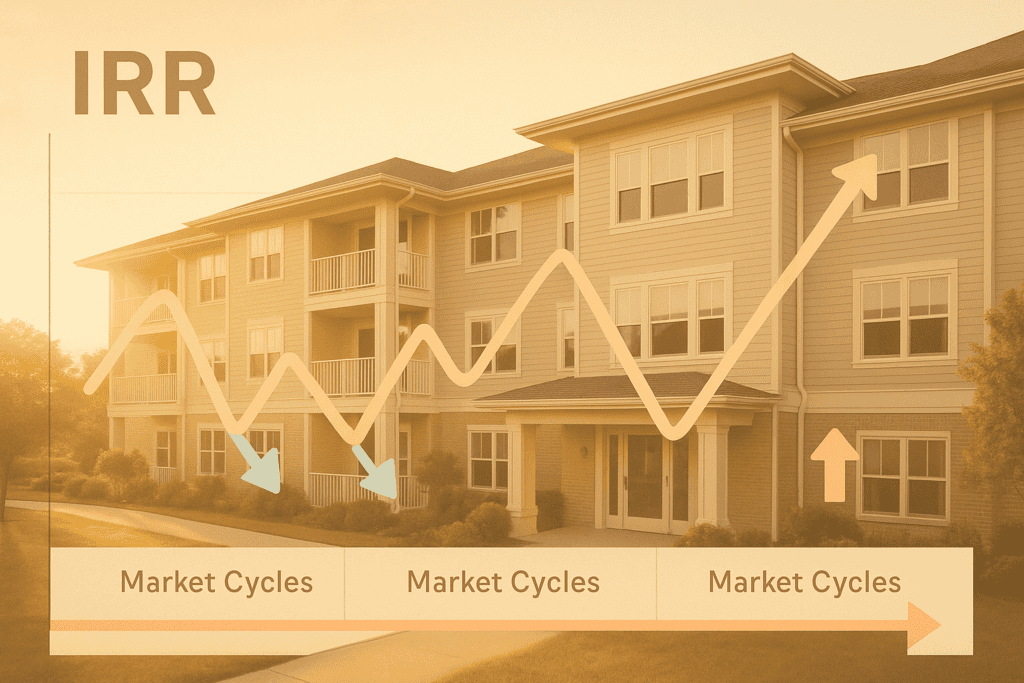

What Happens if Occupancy Drops? Risk Planning Explained

Running a senior living fund isn’t just about stable occupancy and returns—it’s about planning for the dips. Whether it’s a flu outbreak, staff turnover, or local competition, a sudden drop in occupancy can trigger a cascade of financial and operational risks. But if you’re investing in a fund like Shepherd Senior Living, how is this […]

What Happens if Occupancy Drops? Risk Planning Explained Read More »