Introduction

The senior living industry is on the brink of a major transformation, driven by an unprecedented demographic shift. With the Baby Boomer generation aging rapidly, the demand for quality assisted living and memory care is expected to surge. For investors, this presents a unique opportunity to capitalize on a market that is not only expanding but also evolving.

The Silver Tsunami: By the Numbers

- Aging Population Boom: By 2030, all Baby Boomers will be 65 or older, with seniors making up over 20% of the U.S. population.

- Increasing Demand for Senior Living: Over 70% of seniors will require assisted living or memory care at some point.

- Occupancy Rates on the Rise: Senior housing occupancy is rebounding, with many markets experiencing record-high demand.

- Labor Market Challenges: The caregiver-to-senior ratio is shrinking, emphasizing the need for innovative care models.

Why Investors Should Pay Attention

- Resilient Market Growth

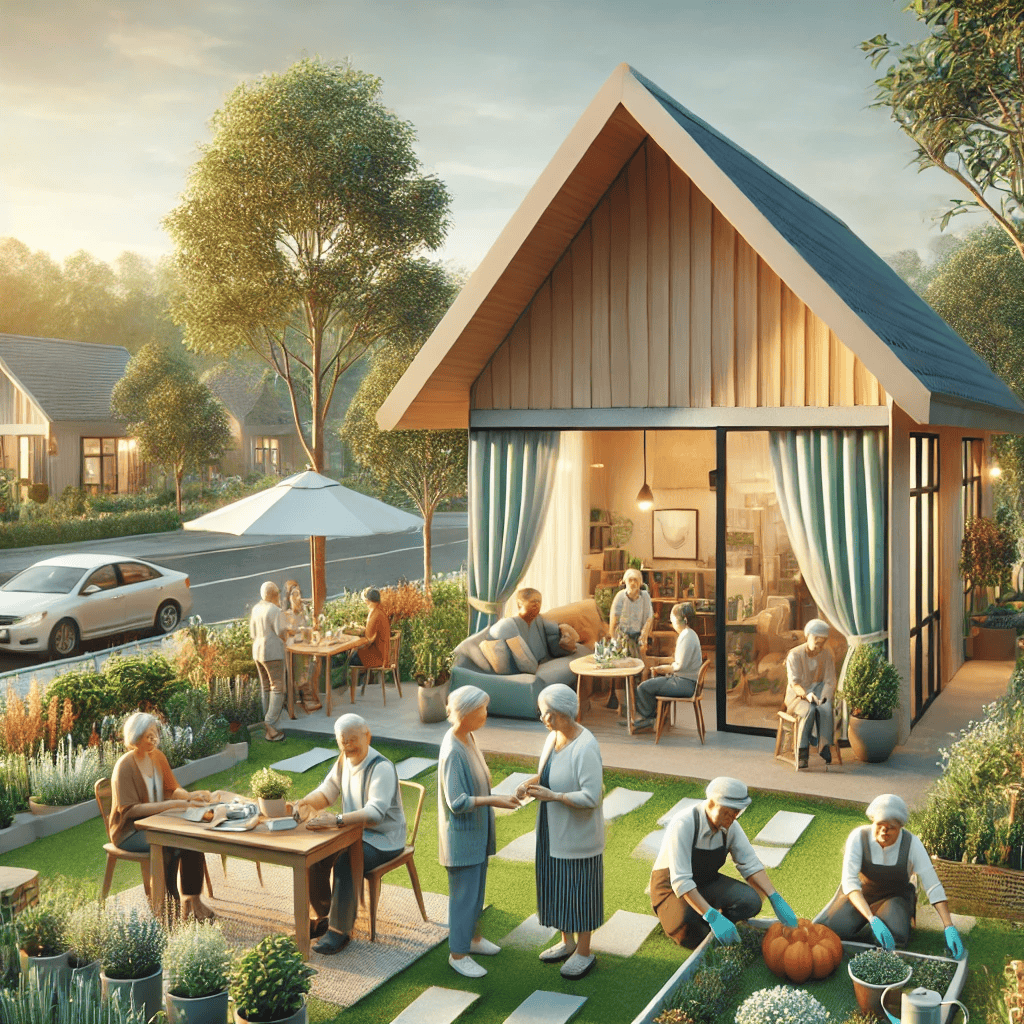

Unlike traditional real estate, senior living is a needs-based industry. Regardless of economic cycles, aging is inevitable, and demand remains steady. - Shift Toward Boutique Senior Living

Large facilities have historically dominated the market, but many seniors now prefer intimate, home-like environments such as those offered by Shepherd Premier Senior Living (SPSL). Smaller, community-driven homes provide higher levels of care and greater resident satisfaction. - Attractive Returns & Scalability

Boutique senior living homes offer strong revenue potential, often outperforming larger facilities in occupancy rates and operational efficiency. - Government & Policy Influence

Policies around aging-in-place, Medicare, and Medicaid funding will further impact senior living investments. Investors should stay ahead of regulatory changes that may create new opportunities or challenges.

Final Thoughts

The demographic surge of seniors isn’t just a trend—it’s a defining investment opportunity of the next decade. Investors who position themselves in the right markets and prioritize high-quality, boutique care models will be well-positioned for success.

If you’re looking for the next big investment wave, senior living should be at the top of your list.