Can Boutique Senior Living Power Up a REIT?

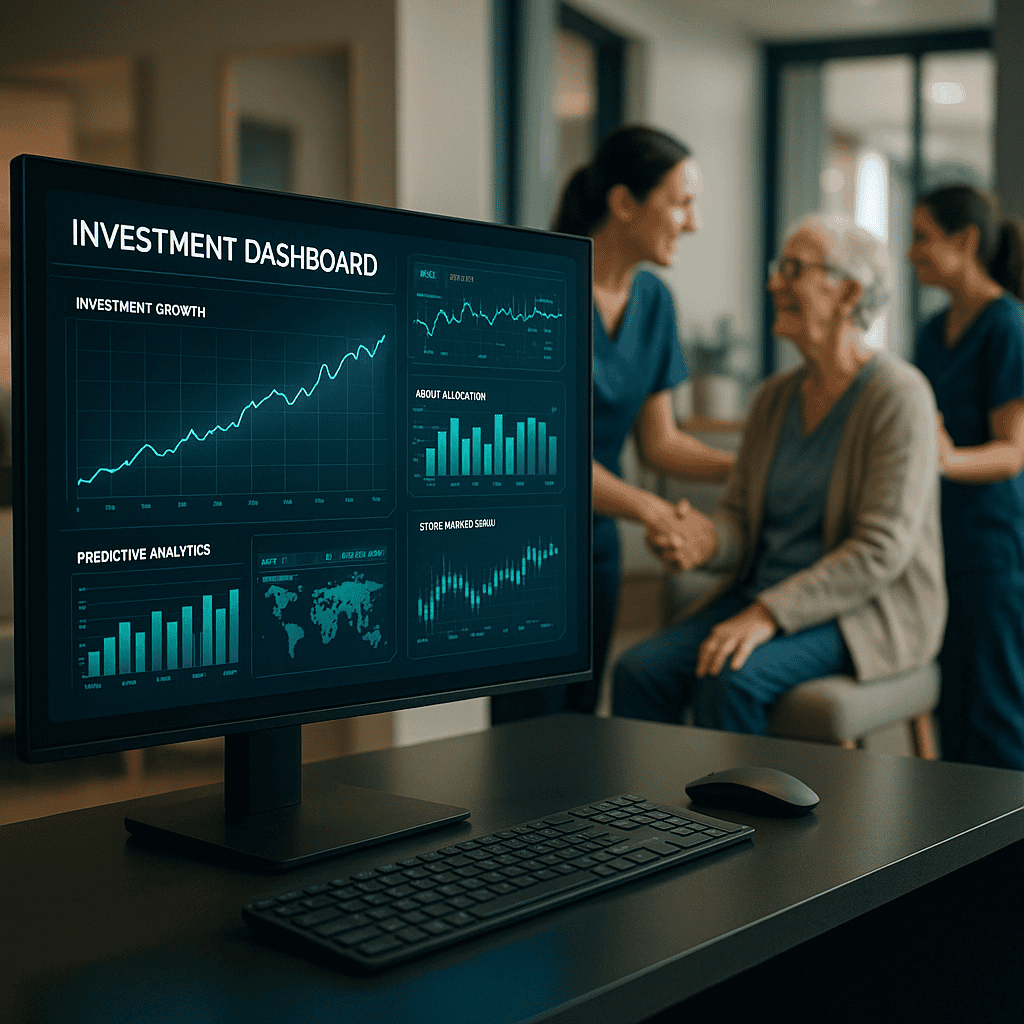

Boutique senior living isn’t just a feel-good mission—it’s becoming a financial engine that could supercharge real estate investment trusts (REITs) 📈. With America’s aging population booming and institutional investors struggling to find high-yield, low-volatility assets, boutique assisted living homes are emerging as high-performance, human-centered alternatives to “big-box” senior housing. Unlike massive facilities with 100+ beds, […]

Can Boutique Senior Living Power Up a REIT? Read More »